Paying an Allowance Without Carrying Cash – Allowance Game Changer

I’ve gotten really annoyed with having cash around to paying for chores and allowance. Who has cash on them ready and waiting? Not me! There has to be an easier way, right!?

What usually happens:

- I promised her I’ll pay her the next day or two usually longer I’m so bad at this.

- I end up letting her spend what I owe her when we are at a store. She never gets the money in hand.

- I actually have the money and pay her when owed only to find it laying around her room or stuffed in a random small box.

Hopefully, I’m not alone in this craziness!

In an effort to pay her allowance without carrying cash, I was considering getting her a PrePaid card like Green Dot. It sounded like a decent solution until I realized how inconvenient adding money to it was. Now it’s not hard to add money and make sense for a monthly deposit but weekly, on the other hand, would require a lot of trips to the local Walmart. I’d be better off heading to the bank and sticking to cash. Oh, and the kicker, their age requirement is 18, she still has a few more years to go :/

Paying an Allowance Without Carrying Cash

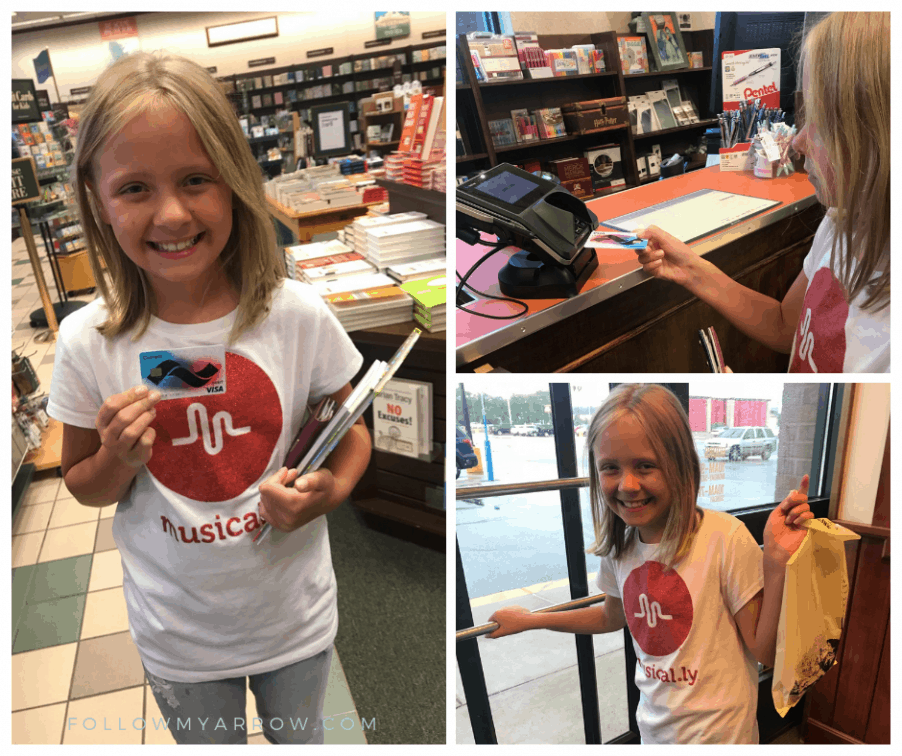

So, this just happened! After completely rejecting that idea I stumbled upon Current. The Current card gives you the convenience of linking to your own bank account which is exactly what I wanted AND is made for teens. I was nearly sold on just that but to my surprise, it had even more to offer:

- Chores – sends reminders/ can mark as completed

- Allowance– set to any schedule

- Limits– set by spending amounts or categories

- Savings– set goals/ can even process roundups from purchases

- Charity– a separate saving for giving back

- Phone app– you have to have a phone and the app installed to use this account

I went ahead and signed up for the trial one month free, ordered her card which was super cute, and set up her virtual wallet.

So far we have been using it for 5 months and have had no plan on stopping. You do need to have a phone or tablet because it is only accessible by app. That hasn’t been a problem because who doesn’t have a smartphone these days. It also has a $3 monthly fee (or $36 annually which is what I did) but honestly, you’ll pay that or more for PrePaids and other Debit Card options. Plus, those are not designed for teens nor do they have any protection for our little munchkins. Small price to pay for “Safe” independence 🙂 You can signup for a free 30-day trial AND get $5 here.

This post contains affiliate links, meaning, at no additional cost to you, if you click through and make a purchase, I may receive a commission. I only share items that I truly love and use myself. For more information please see my disclosures here.

My Favorite Features

- Links to my checking account. I have two options when sending money:

- Load my parent account and have funds ready – this makes the transfer to her account a but faster.

- Have the funds transferred from my account each time I send money to her – this takes an extra day or so but the funds show as “pending” on her end so she knows it’s coming 🙂

- Chores- this feature lets me set up recurring chores and one-offs. Here’s what happens:

- I create it

- It gets sent to her

- She completes it and marks it as “DONE”

- I get a notification and can pay when I’m ready

- Options for saving plus a roundup option on every purchase which automatically takes the change and transfers to savings.

- Goal – She can choose what she wants to save for and how much she needs.

- Charity – Connects with hundreds of options so you don’t have to do a thing except confirm the amount when ready.

- Limit the categories she can spend her earned money on:

- You can exclude things like gambling, hotels, ATM, etc.

- Or exclude specific merchants by setting up blocks.

- Budget teacher – You are able to see every aspect of your money- from earning to savings to spending.

- Any adult with a bank account can contribute AND multiple people can set up “Parent” accounts. So that means Grandparents, Aunts, and Uncles can also easily send funds too.

Safety

One of my biggest fears of letting my daughter have a debit card was the “what if’s”. What if she losses it or it’s stolen? When I was researching other options such as a prepaid card, the protection against loss or theft of money was nearly nonexistent. With the Current card, you can prevent or stop any fraudulent activity in seconds by logging in and selecting “Pause”. Plus, if any unauthorized transactions do sneak through, you can simply call Current to dispute the transactions just like any other debit or credit card. You can’t do that with a PrePaid or Gift Cards.

Conclusion

I am extremely excited to report paying an allowance without carrying cash makes us both happy after our finishing our five month trial! Needless to say, the choice was right for us. It’s saved me from mounds of IOU’s and letting her make impulse purchases at the store just so I don’t “owe” her anymore. She can now see how quickly money goes since our money tree hasn’t been planted yet and how satisfying it feels to reach a savings goal. Even more important, we don’t have money stuffed in random bags in her room leaving her guessing how much $$$ she actually has! I’d go as far to say this is a learning tool for teens just as much as it it is a convenience option for parents so, WIN WIN!!

Want to give it a try too? You can signup for a free 30-day trial AND get $5 here. I promise it’s so worth it!

Love it? Share it!

3 comments

What a wonderful app! I use one right now called Chore Monster. My kids are still fairly small so it’s getting them use to the routine of having chores! Maybe I’ll go check this one out!!

It’s a sanity saver for sure!

Wow this really does seem like great set of features. I started reading with the expectation that it wouldn’t be much more than a glorified prepaid card or credit union account, but it’s so targeted to exactly this purpose, its great! Plus it gives good practice at using card over cash so they aren’t tempted to spend more than they have once they’re old enough for credit.